Corporate Governance

Corporate Governance and Internal Control System

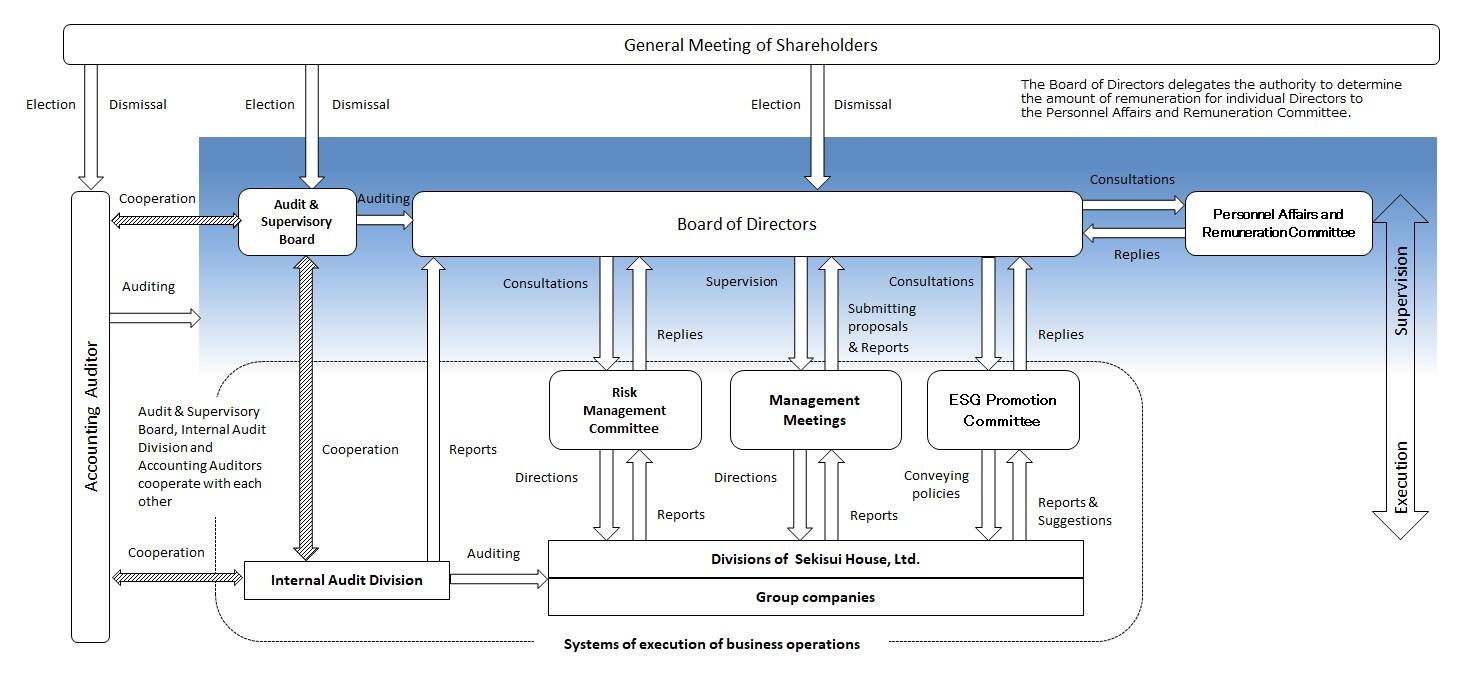

Sekisui House Ltd. (the Company) considers corporate governance as one of the major management priorities in the sense of enhancing the trust of stakeholders. To ensure management transparency and provide for timely and appropriate checking and monitoring, five outside directors and three outside audit & supervisory board members are in place. With the aim of clarifying operational responsibilities and ensuring flexible business execution, the Company has introduced executive officer system.

Regarding the internal control system, the Company is thoroughly implementing and strengthening the operation of the system based on the Basic Policy Concerning the Development of an Internal Control System.

The J-SOX Group within the Accounting Department is responsible for thorough compliance of the group-wide internal controls based on the Financial Instruments and Exchange Act (J-SOX).

Corporate Governance Structure

Sekisui House, Ltd. Basic Policy on Corporate Governance

The Sekisui House Group publish and disclose the concept and frameworks of corporate governance to stakeholders and strive to continuously improve the system.

- Basic Policy on Corporate Governance (PDF 317KB)

- List of Matching Items of Corporate Governance Code (PDF 108KB)